Trusts Set Up And Management

The current economic and political global environment, the uncertainties in the European context and growing social conflicts, are now emphasizing the need to adequately safeguard personal and familiar wealth against possible unexpected and far-reaching events, predatory legal actions, potential fraud attempts and unprofitable changes in tax laws.

Further, attention should also be dedicated to the need to ensure a smooth generational transfer of family assets.

The international Trust is a specific and perfect instrument to manage the above situations ensuring, in the meantime a high level of privacy, in full compliance with existing laws and tax regulations.

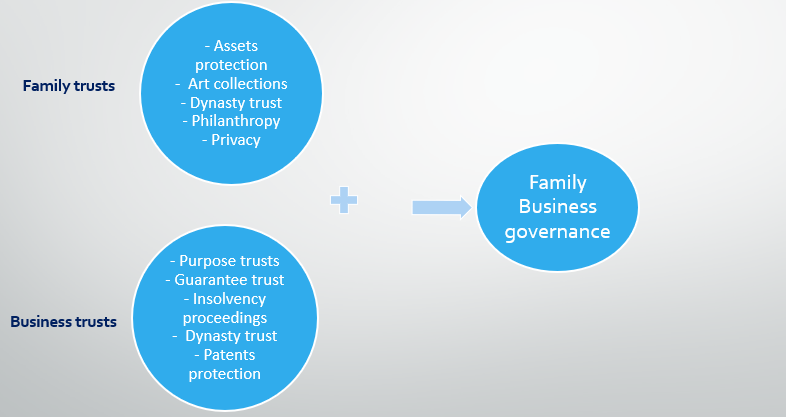

The most attractive element of a Trust, in general, is its extreme flexibility, in so far as it can fit virtually any need, within its purpose. Actually, purposes of a Trust are numerous and can be summarized as follows:

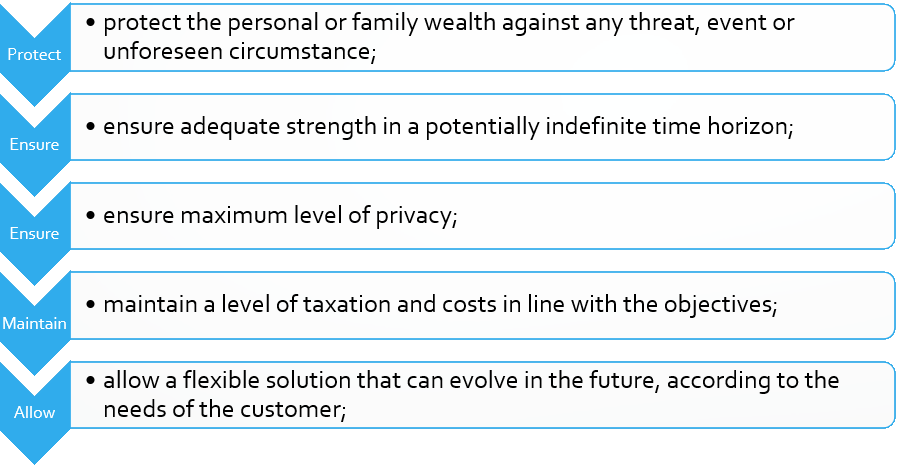

A Trust, therefore, may be able to:

A Trust is able to:

- offer a level of control and protection over family assets against any threat or unforeseen circumstance that other wealth management options cannot satisfy;

- ensure adequate strength over an indefinite time horizon, for those who wish to pass on their wealth down through successive generations;

- allow a flexible solution that can evolve in the future, according to the needs of the settlor;

- protect vulnerable persons with physical or mental disability, who would not normally be able to undertake decisions regarding the management of their assets;

- protect assets within the marriage relationship;

- ensure maximum level of privacy.

Do you need further information? Go to our FAQ section or contact us

Frequently Asked Questions

- 1) What is a Trust?

- 2) Who are the parties of the Trust

- 3) What are the advantages and benefits to setting up a trust?

- 4) Do I need a Trust?

- 5) Is a Trust expensive?

- 6) What happens if I change my mind when the Trust is done?

- 7) Which assets can be settled into a Trust?

- 8) What does it mean that the assets settled into a Trust are 'segregated'?

- 9) How long does a Trust last?

-

1) What is a Trust?

A Trust is a legal relationship arising from the draft of a Deed of Trust between living persons or a will, whereby a person (the Settlor) transfers properties, liquidity or other assets or rights to another person (Trustee) with the latter's obligation to manage and administer them in the interests of the Settlor or another person (Beneficiary) or for the pursuit of a specific purpose, under the possible supervision of a third party (Protector), in accordance with the rules laid down by the settlor in the Trust Deed and the law governing the Trust.

A trust has the following key characteristics:

- The trust assets constitute a segregated fund and are not a part of the trustee assets.

- Legal title to the trust assets stands in the name of the trustee.

- The trustee has the power and the duty, in respect of which he is accountable, to manage, employ or dispose of the assets in accordance with the terms of the trust deed and the special duties imposed on him by law.

- The reservation by the settlor of certain rights and powers, and the fact that the settlor may also be a beneficiary, are not inconsistent with the existence of a trust and do not affect its existence.

-

2) Who are the parties of the Trust

The parties of a Trust, usually are:

The Settlor

The settlor is a person who creates the trust settling assets into it.

The Trustee

The Trustee is the legal owner of the assets held in a Trust and he is responsible for holding and managing the Trust assets in the best interests of the beneficiaries.

The main features of his role consist of:

- deal with the Trust assets according to the settlor’s wishes, as set out in the Trust Deed (or their will)

- manage the Trust on a day-to-day basis and pay any tax due

- decide how to invest or use the Trust’s assets

The Beneficiary (ies)

A Beneficiary is someone who can, or will, benefit from the Trust. The rights a beneficiary has over the trust assets will vary depending on the Trust. A Beneficiary may benefit from the income of a Trust only, or the capital only, or both the income and capital of the Trust.

The Protector

A Protector is a person who holds powers under a Trust but who is not a Trustee. A Protector is a person who is independent of the Trustee. The Protector's role is usually to monitor, oversee or control the administration of the Trust by the Trustee.

-

3) What are the advantages and benefits to setting up a trust?

Advantages and the best benefits that the Trust can offer are the segregation of assets that, when done in accordance with the law and the best practices, makes such assets absolutely protected with respect to any third party.

Further, the Trust allows the Settlor to plan his/her future and that of the people they want to protect through an extremely flexible tool that can be adapted, over time, to every type of need.

-

4) Do I need a Trust?

YES, if you are a professional and your business is exposed to considerable civil liability and you want to protect you and your family.

YES, if you are an entrepreneur and want to plan today a smooth passage to your heirs of your business, avoiding future internal conflicts that could compromise the company itself.

YES, if you wish to protect a weak person over time or when you can no longer do it.

YES, if you are alone and you are worried about your future.

YES, if you need to guarantee relevant transactions, without committing all your personal assets

YES, if you want to regulate property relationships between spouses, between civil partners or between cohabitees more uxorio, or between former spouses during separation or divorce.

YES, if you want to achieve an altruistic or charitable purpose.

NO, if you are only looking for a tax benefit today or over time

-

5) Is a Trust expensive?

As a general rule, a Trust is an instrument that needs to be tailored to the individual needs and requirements of the settlor, so the cost associated with its creation cannot be standardised as it depends on the difficulty and complexity of the project, the number and type of assets to be placed in the Trust (and not their value), and numerous other factors.

The feasibility study is essential to avoid creating a trust (which is a long-term relationship) tainted by errors of form and/or substance.

The study is done by the Trustee, possibly in cooperation with professionals chosen by the Settlor. Should the law provide for the creation of the Trust by public deed, it is also necessary to consider the notary's fees and taxes relating to any transfers of real estate or registered movables and shares in companies.

After the creation of the Trust, there are costs relating to its maintenance and the management, by the trustee, of the assets transferred.

Even in that case, the costs are variable and depend on the tasks to be performed by the trustee during the lifetime of the Trust, since, depending on their type, different administrative burdens depend on different costs to be borne by the Trust.

In principle, three types of fees can be envisaged:

a) Administration fee

This fee relates to the administrative activities of the trustee and includes all non-management activities, such as, for example: bookkeeping, preparation of trust annual accounts, attending any meeting, management of current accounts, preparation of Trust's tax returns.

b) Accountability fee

This fee relates to more strictly management activities and is proportional to the complexity of the assets transferred.

c) Distribution, Dissolution and/or Replacement Trustee or Co-Trustee Fees

These fees are payable in respect of the activities necessary to make distributions of the Trust assets, to carry out the dissolution of the Trust and/or to transfer the assignment to another Trustee or co-Trustee.

-

6) What happens if I change my mind when the Trust is done?

Nothing. The Trust is an extremely adaptable and flexible legal instrument over time; hence it will be able, (if drafted in accordance with your initial wishes), to comply with all the needs that will arise over time, quickly adapting to the new needs.

-

7) Which assets can be settled into a Trust?

There are no limitations. It is possible to settle into a Trust any type of assets and rights. For example:

- company shares

- real estate;

- money;

- insurance policies;

- unites of funds;

- listed and unlisted shares and bonds;

- credit rights;

- copyrights;

- precious objects (e.g. jewellery);

- artworks and collections.

-

8) What does it mean that the assets settled into a Trust are 'segregated'?

A Trust allows a person (the Settlor) to transfer the ownership of part of his(her) personal assets to another person (the Trustee), so that the latter administers and manages them in the interests of one or more persons (the Beneficiaries), or for the pursuit of a specific purpose, in accordance with the provisions of the Trust Deed.

The power exercised by the Trustee rests on a causa fiduciae; therefore, the exercise of the right of ownership is bound to the implementation of the programme defined in the deed of Trust.It follows that the assets transferred into a Trust are subject to a destination restriction and form a separate fund with respect to the patrimonial sphere of both the Trustee, the Settlor, the Protector and, of course, the Beneficiaries.

The segregative effect arises precisely from this separation of assets that occurs when assets are placed into a trust.

Another consequence of the segregation is that third party creditors are not allowed to satisfy their claims on the trust fund (unless the trust was created by the settlor in fraud of creditors). -

9) How long does a Trust last?

The duration of a Trust is determined by the Settlor, so can be variable, and is set out in the trust deed.

In general terms, a Trust cannot last in "perpetuity" (except for purpose trusts, in those jurisdictions that allow them) and the maximum limit of years is set by each governing law.

By way of example, the English law defines the "period of perpetuity", i.e. the maximum duration of a trust, as 125 years, as does the Law of Malta, while the Jersey Law states that a trust may remain in force for an unlimited time.

Our Services

NewHorizon Trustee Services Limited

16 Upper Woburn Place - London WC1H 0AF

United Kingdom

Company Number: 14161997